Get the free ct 4422 ige

Show details

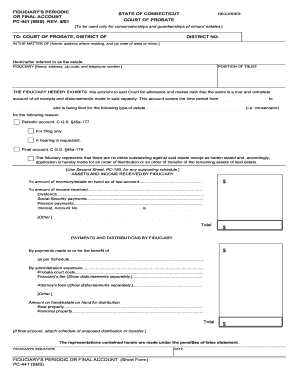

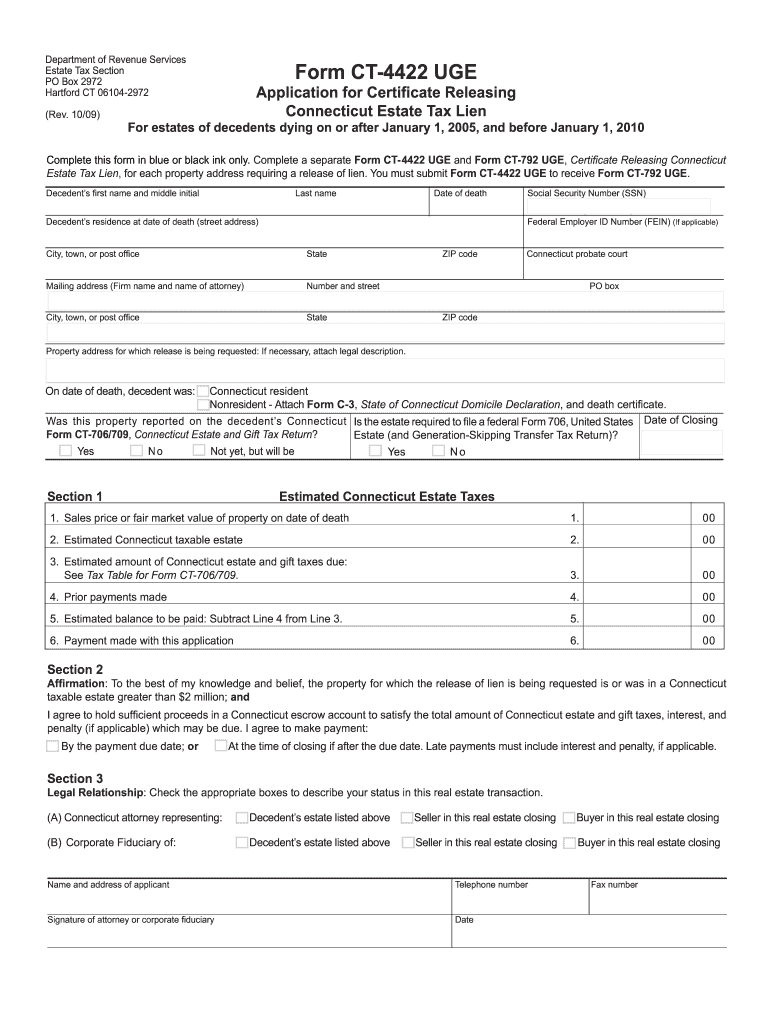

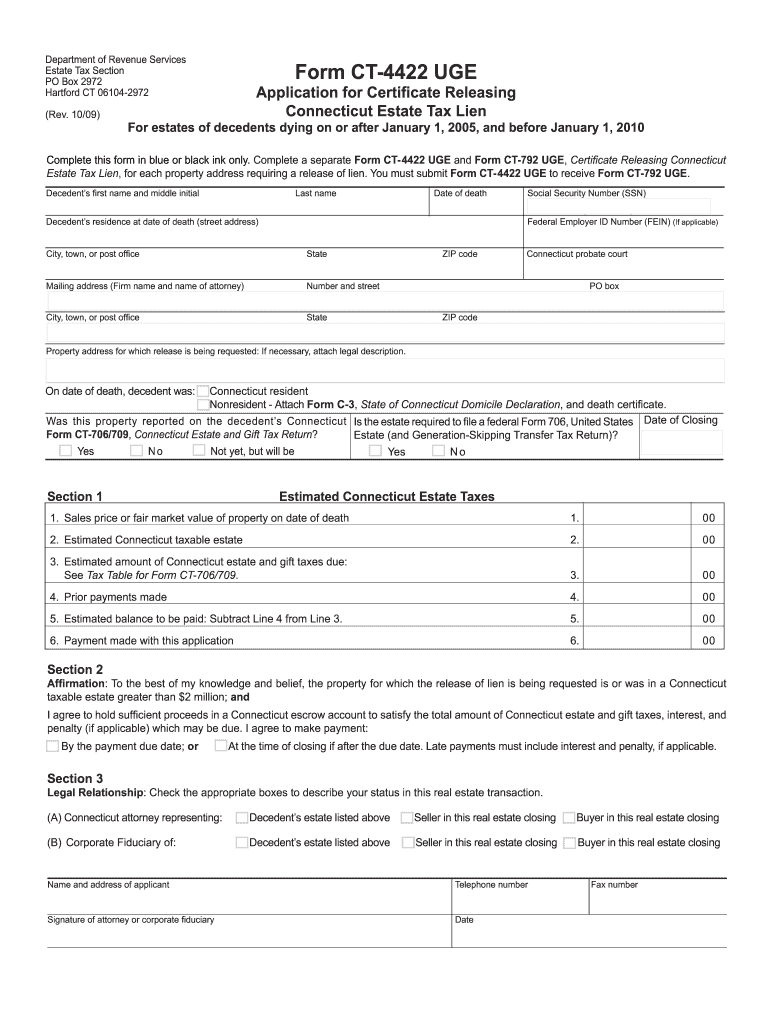

Payment of the estate tax is due within six months after the date of the decedent s death unless an extension of time to pay has been granted. Where to File You may file your completed Form CT-4422 UGE by fax mail or in person at the DRS main office. RESET Department of Revenue Services Estate Tax Section PO Box 2972 Hartford CT 06104-2972 Rev. 10/09 PRINT Form CT-4422 UGE Application for Certificate Releasing Connecticut Estate Tax Lien For esta...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct 4422 ige

Edit your ct 4422 ige form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 4422 ige form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct 4422 ige online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ct 4422 ige. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct 4422 ige

How to fill out ct 4422 ige:

01

Start by carefully reading the instructions provided with the form.

02

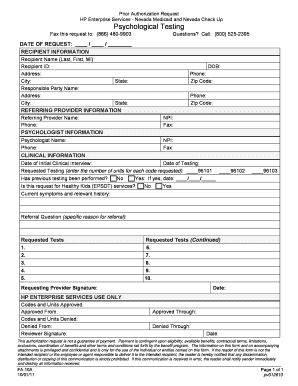

Gather all the necessary information and documents required for the form, such as personal identification details and relevant supporting documents.

03

Begin filling out the form by providing your personal information, including your name, address, and contact details.

04

Follow the instructions on the form to provide specific details, such as the purpose of the form and any relevant dates or events.

05

Double-check all the information you have entered to ensure accuracy and completeness.

06

Sign and date the form as required.

07

Review the completed form one last time before submitting it, ensuring that all the required fields have been filled and all information is accurate.

Who needs ct 4422 ige:

01

Individuals who are required to provide detailed information for a specific purpose or event may need to fill out ct 4422 ige.

02

This form may be necessary for various reasons, such as applying for certain government programs, requesting specific services, or providing information for legal or administrative purposes.

03

The specific requirements for needing ct 4422 ige can vary depending on the situation, so it is important to carefully read any instructions or guidelines provided to determine if this form is necessary in your particular case.

Fill

form

: Try Risk Free

People Also Ask about

What is the estate exemption in CT 2023?

Starting in 2023, the Connecticut lifetime gift and estate tax exemption amount will match the federal gift and estate tax exemption amount, meaning that the Connecticut exemption will increase from $9.1 million to $12.92 million on January 1, 2023. The top Connecticut gift and estate tax rate remains 12%.

Who must file a CT estate tax return?

The executor or administrator of the decedent's estate must sign and file Form CT‑706 NT. If there is no executor or administrator, then each person in actual or constructive possession of any property of the decedent must file Form CT‑706 NT. If there is more than one fiduciary, all must sign the return.

Do you have to pay taxes on an inheritance in CT?

Yes. The real property and tangible personal property of non-residents are taxable if the property is situated in Connecticut. All three classes of property are taxable if the deceased was a Connecticut resident except real property and tangible personal property located outside Connecticut. Q.

Do you pay taxes on inheritance in CT?

Yes. The real property and tangible personal property of non-residents are taxable if the property is situated in Connecticut. All three classes of property are taxable if the deceased was a Connecticut resident except real property and tangible personal property located outside Connecticut. Q.

How much is inheritance tax in CT?

There is an estate tax in Connecticut. As of 2023, there is a flat estate tax rate of 12%.

What is the CT estate tax exemption?

For estates of decedents dying during 2022, the Connecticut estate tax exemption amount is $9.1 million. Therefore, Connecticut estate tax is due from a decedent's estate if the Connecticut taxable estate is more than $9.1 million.

What is the estate tax exemption in Connecticut 2023?

Starting in 2023, the Connecticut lifetime gift and estate tax exemption amount will match the federal gift and estate tax exemption amount, meaning that the Connecticut exemption will increase from $9.1 million to $12.92 million on January 1, 2023. The top Connecticut gift and estate tax rate remains 12%.

What is the gift and estate tax in Connecticut?

Connecticut State Gift Tax Rate: 11.6% (if the value of the taxable estate/gift is $9.1 to $10.1 million) or 12% (if the value is greater than $10.1 million)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ct 4422 ige in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ct 4422 ige and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send ct 4422 ige for eSignature?

Once you are ready to share your ct 4422 ige, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the ct 4422 ige electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ct 4422 ige in seconds.

What is ct 4422 ige?

CT 4422 IGE is a form associated with the Connecticut Revenue Services used for reporting certain financial information by taxpayers.

Who is required to file ct 4422 ige?

Taxpayers who meet specific criteria, usually those involved in certain business activities or financial transactions in Connecticut, are required to file CT 4422 IGE.

How to fill out ct 4422 ige?

To fill out CT 4422 IGE, one must provide all requested personal and financial information as outlined on the form, ensuring accuracy and completeness before submission.

What is the purpose of ct 4422 ige?

The purpose of CT 4422 IGE is to assist in reporting income, expenses, and other financial activities to the Connecticut Department of Revenue Services for tax assessment.

What information must be reported on ct 4422 ige?

CT 4422 IGE must report information such as taxpayer identification, income details, expense records, and other relevant financial data pertaining to the reporting period.

Fill out your ct 4422 ige online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct 4422 Ige is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.