Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

The term "CT 4422 IGE" is not specifically known or recognized. It is possible that it could be a code or reference specific to a certain industry or field, but without additional context or information, it is difficult to provide a definitive answer. It would be helpful to provide more details or clarify the context in which this term is being used.

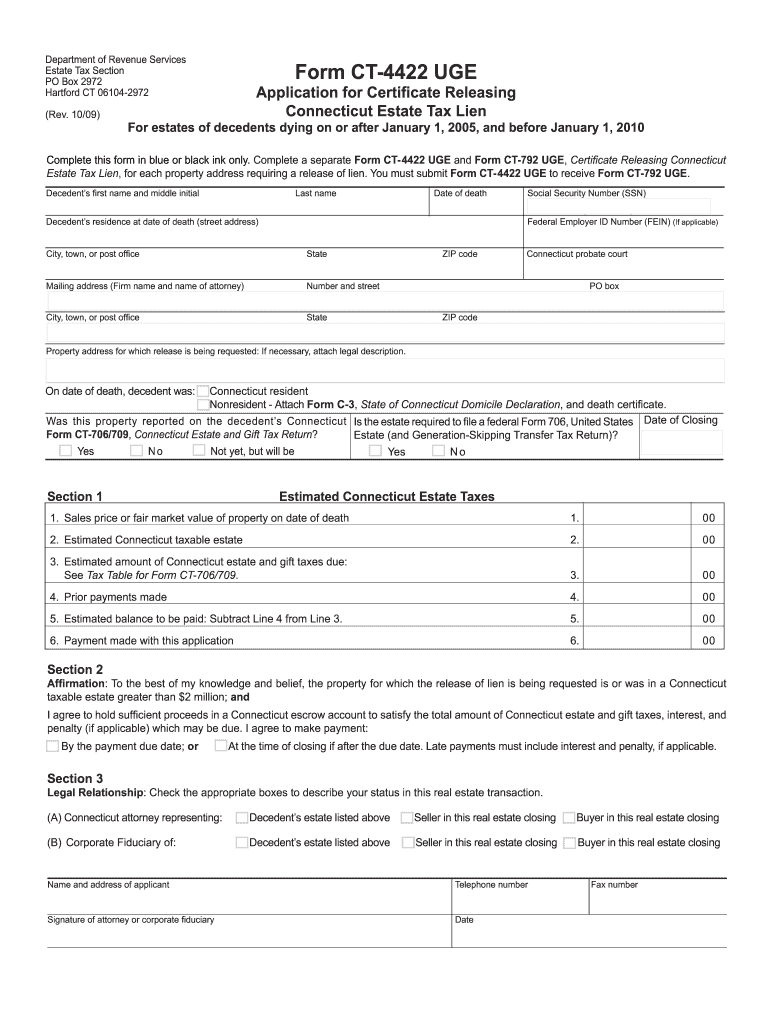

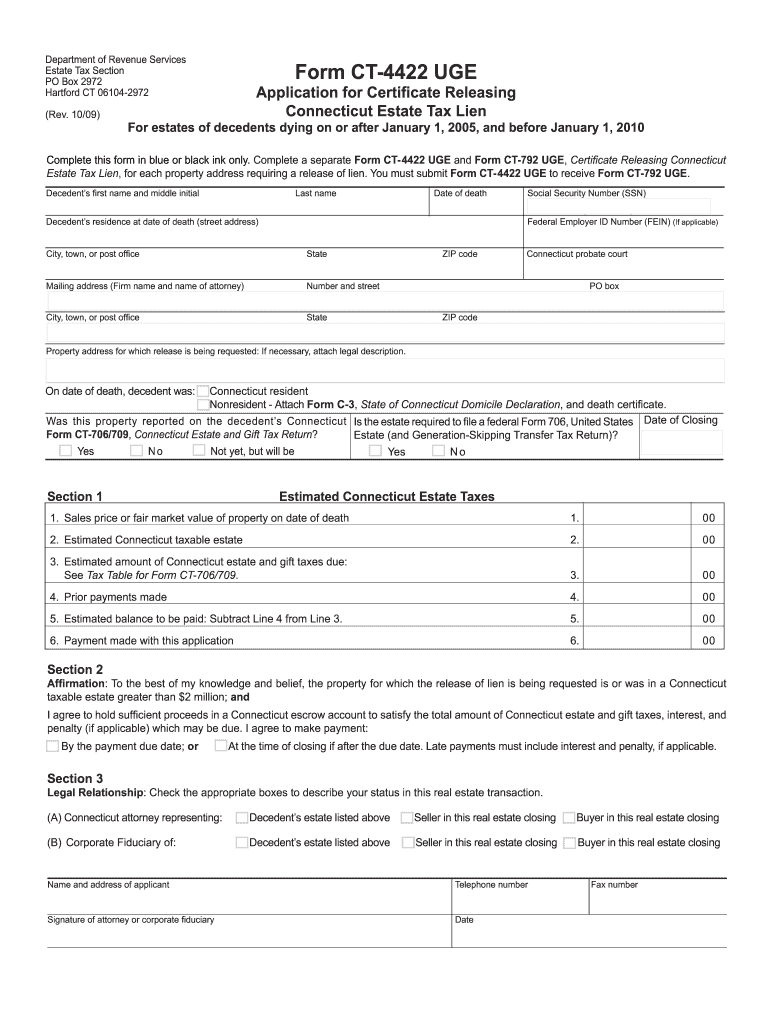

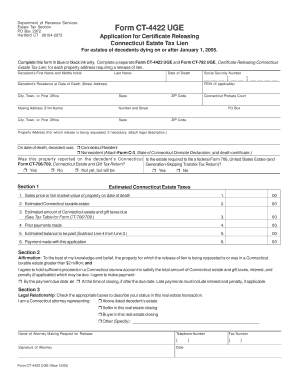

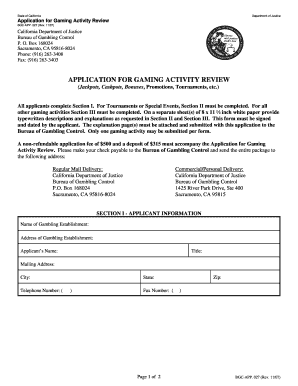

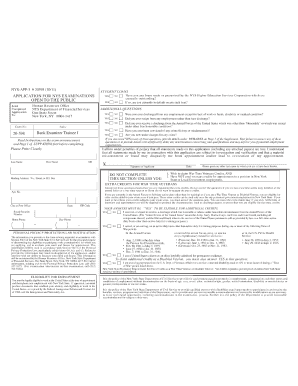

How to fill out ct 4422 ige?

Filling out form CT 4422 IGE (Interstate Gross Earnings) involves providing information regarding the gross earnings derived from interstate activities. Here are the steps to fill out the form:

1. Heading: Enter the tax year and your business name and address at the top of the form.

2. Section I: Provide information about your business activities.

- Check the appropriate box to describe the nature of your business.

- If your business is not an individual, partnership, or corporation, select the "Other" box and specify the type of entity.

3. Section II: Indicate the form of ownership by checking the relevant box.

- If your business is a sole-proprietorship, provide your Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- For partnerships and corporations, enter the FEIN.

4. Section III: Calculate your total Connecticut gross earnings by adding up the gross earnings from all your interstate activities.

- If you have multiple pages of earnings, complete Schedule A-1 and include the total on line 17 of form CT 4422 IGE.

5. Section IV: Determine the apportionment percentage.

- Complete Schedule A-2 to calculate the apportionment percentage based on your Connecticut and interstate gross earnings.

- Transfer the percentage to line 19 of form CT 4422 IGE.

6. Section V: Compute the taxable Connecticut gross earnings.

- Multiply the apportionment percentage (line 19) by the total Connecticut gross earnings (line 18) to get the taxable Connecticut gross earnings (line 20).

7. Section VI: Sign and date the form.

- The form must be signed by the business owner or authorized officer, partner, or member if the business is not an individual.

Remember to review the completed form for accuracy and completeness before submitting it. It's advisable to consult a tax professional or refer to the Connecticut Department of Revenue Services' instructions for further guidance.

What is the purpose of ct 4422 ige?

CT 4422 IGE is not a widely known or recognized term. It might refer to a specific laboratory test or blood marker, but without more information, it is difficult to determine its exact purpose. It is recommended to consult with a healthcare professional or provide more context to gain a better understanding of the term.

What information must be reported on ct 4422 ige?

The form CT 4422 IgE is used to report information about individuals with immunoglobulin E (IgE) deficiencies, which are related to certain medical conditions and allergies. The specific information that needs to be reported on this form may vary depending on the requirements and guidelines set by the organization or institution using the form. However, typical information that may be required includes:

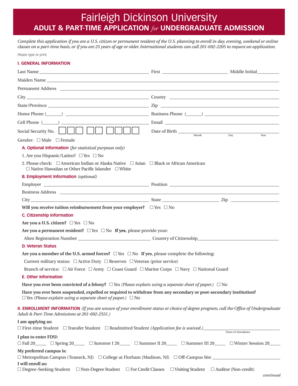

1. Patient Information: Name, date of birth, gender, contact details, and other relevant identification information.

2. Clinical Details: Detailed medical history, including information about any known allergies, respiratory conditions, and other relevant health disorders.

3. Laboratory Tests: Results of various IgE-related laboratory tests, including total IgE levels, specific IgE levels for different allergens, and any other relevant immunological test results.

4. Diagnosis and Findings: Details of the diagnosis made by the healthcare professional, including the specific immunodeficiency condition, if applicable.

5. Treatment and Medications: Information about any treatments, medications, or therapies prescribed or administered to manage the condition, including dosage and frequency.

6. Physician Information: Details of the healthcare professional, including their name, contact information, and any other relevant credentials.

It is important to note that the specific requirements may vary, so it is necessary to follow the provided instructions or consult the relevant authorities for the accurate details to be reported on form CT 4422 IgE.

How do I modify my ct 4422 ige in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ct 4422 uge form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send fillable ct form 4422 for eSignature?

Once you are ready to share your form ct 4422 uge, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the form ct 44223 uge electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ct 4422 ige in seconds.